where's my unemployment tax refund tool

If you are among the millions of Americans waiting for the money you can check the payments status by using the IRS Check My Refund Status tool which is designed to people track the status of. Viewing your tax records online is a quick way to determine if the IRS processed your refund.

Tax Refund Delays Could Continue As Backlog Of Tax Returns Is Growing Tax Advocate Says Cbs News

- One of IRSs most popular online features-gives you information about your federal income tax refund.

. Your Adjusted Gross Income AGI not including unemployment is. Online Account allows you to securely access more information about your individual account. The best way for taxpayers to check the status of their refund is to use the Wheres My Refund.

You did not get the unemployment exclusion on the 2020 tax return that you filed. The refund is due to the citizens overpayment of benefits tax after the IRS added a tax exemption for the first 10200 US dollars of unemployment benefits. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

Check your unemployment refund status by entering the following information to verify your identity. You will need your Social Security number or ITIN and your exact refund amount. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. If your mailing address is 1234 Main Street the numbers are 1234. Go check your transcripts and bank accounts folks.

During the 2022 tax season many Reddit tax filers who filed early say they received the Tax Topic 152 notice from the Wheres My Refund tool accompanied by a worrisome message. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund. You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools.

Another way is to check your tax transcript if you have an online account with the IRS. We apologize but. Up to 3 months.

Also the CTC portal is still not showing my August payment. If you are waiting on your refund especially if you filed an amended return check your refund status online. You get personalized refund information based on the processing of your tax return.

Can You File For Extension On Unemployment. Their Social Security number. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount.

All they need is internet access and three pieces of information. This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. Wheres My Refund.

Ad Learn About the Common Reasons for a Tax Refund Delay and What To Do Next. Another way is to check your tax transcript if you have an online account with the IRS. Adjusted Gross Income AGITotal Household Resources THR.

How Do I Get My 1099 From Unemployment. The exact whole dollar amount of their refund. Just checked my bank and the CTC is there.

Ad See How Long It Could Take Your 2021 State Tax Refund. Primary filers Social Security number. 24 hours after e-filing 4 weeks after you mailed your return Updates are made daily usually overnight.

If you use Guest Services select Wheres My Refund and you will be asked to enter the following information for security reasons. When Will I Get My Unemployment Tax Refund. Your tax on Form 1040 line 16 is not zero.

John P-January 30 2022. One of the lesser-known provisions of the 19 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits which offers a considerable tax exemption. How long it normally takes to receive a refund.

You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal. After this you should select the 2020 Account Transcript and scan the transactions section for any entries as Refund issued. Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud and identity theft.

Check For the Latest Updates and Resources Throughout The Tax Season. This is available under View Tax Records then click the Get Transcript button and choose the. One Stop Towing Roanoke Va Hutchs Truck Stop Top 10 Lump Charcoal Top 10 Coal Mining Companies.

Use our refund status application which is available 247 and provides the same information as our customer service representatives. Treasury Secretary of State UnemploymentUIA 2. Why is my IRS refund taking so long.

Still they may not provide information on the status of your unemployment tax refund. Primary filers last name. The tool provides the refund date as soon as the IRS processes your tax return and.

Up to 3 weeks. What Ticket Number Is Pa Unemployment On. The Internal Revenue Service doesnt have a separate portal for checking the unemployment compensation tax refunds.

Will The Unemployment Be Extended. Based on recent calculations the refund resulted in a total of 510 million US dollars. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

This tool gives taxpayers access to their tax return and refund status anytime. Just got my transcript updated with the unemployment tax refund date of 818. The tool tracks your refunds progress through 3 stages.

In fact during the first week of November IRS sent a total of 430000 tax refunds to qualified. Offer helpful instructions and related details about Wheres My Unemployment Tax Refund - make it easier for users to find business information than ever. Check My Refund Status Wheres My Refund.

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

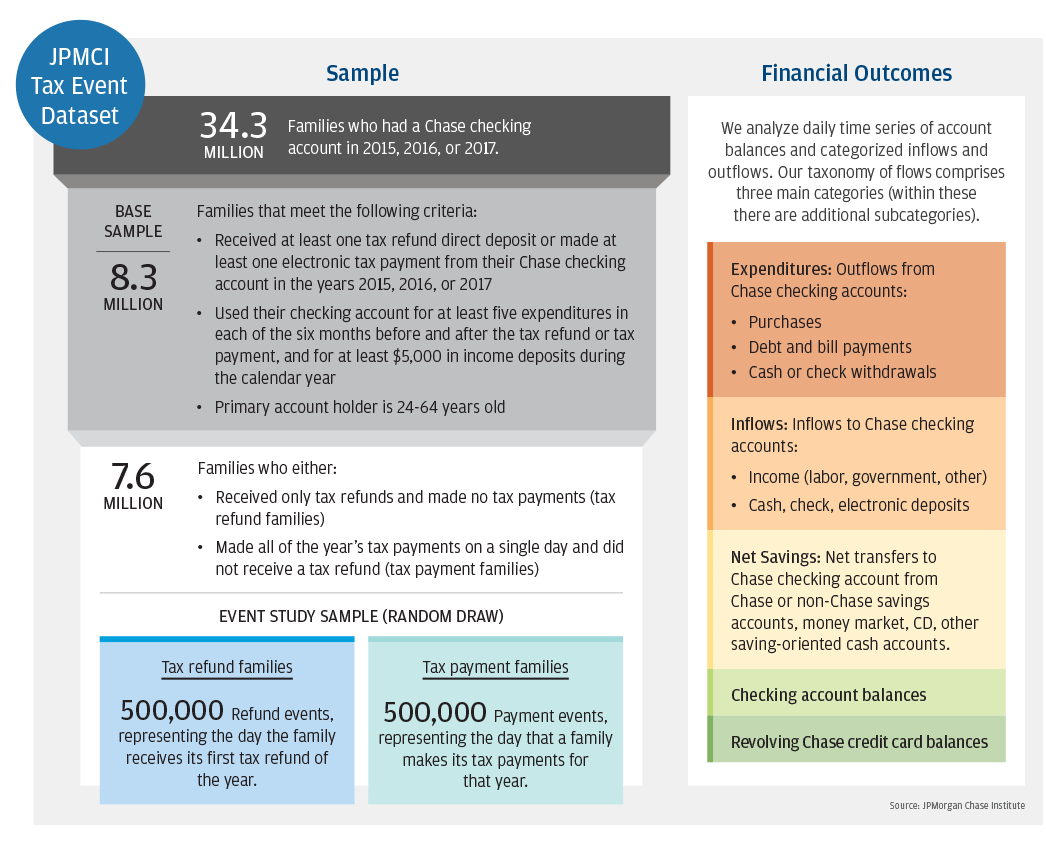

Tax Time How Families Manage Tax Refunds And Payments Jpmorgan Chase Institute

Tax Refund Delays Reasons Why Your Irs Money Hasn T Arrived Yet Cnet

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Fury As Major Tax Refunds Are Delayed For Millions Of Americans Because Irs Staffers Are Working From Home

Americans Should Be Prepared For A Smaller Tax Refund Next Year

Tax Refunds On 10 200 Of Unemployment Benefits Start In May Irs

Waiting On Tax Refund What Return Being Processed Status Really Means

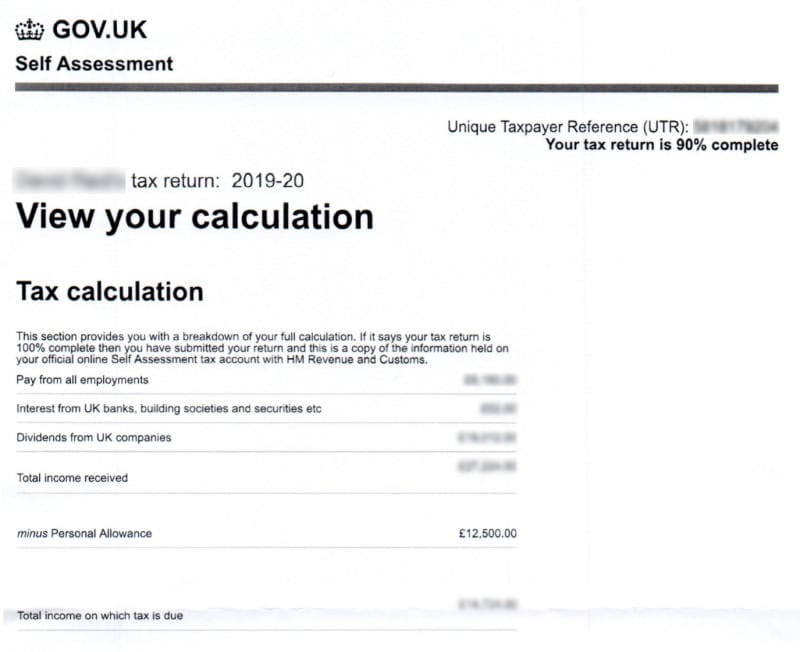

Hmrc Tax Refunds Tax Rebates 3 Options Explained

Here S How To Track Your Unemployment Tax Refund From The Irs

Will Tax Refunds Be Lower This Year For Americans As Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Get My Refund 12 Million Tax Returns Trapped In Irs Logjam Should Be Fixed By Summer 6abc Philadelphia

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How Long Will It Take To Get Your Tax Refund Here S How To Track Your Money Cnet

How Do I Claim Tax Back Low Incomes Tax Reform Group

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Breaking Down The Delay In Tax Refunds For Millions Of Taxpayers